Our story is your story

You’ve discovered Fundingteam. Behind Fundingteam is a vision and mission because Fundingteam is more than just a financing method. Fundingteam is a movement of entrepreneurs. A community where we learn from each other. By mail, on the website or in a conversation, only a tip of the veil can be lifted from our story. Would you like to read our story? Then you will find it on this page. We hope it will be your story too.

We get thousands of responses. Very sometimes very short: Dear,

Just state what you can offer. Have been scammed enough unfortunately.

Kind regards, J.J. Blok Dear Mr. Blok, We fully understand your question in your email. You have had bad experiences. Your story is unfortunately also the story of thousands of other entrepreneurs. We gladly take the trouble to tell you our story because Fundingteam is there precisely to help and inform you as an entrepreneur. Fundingteam’s story is the story with the solution to a great challenge. What is this story? The big challenge As an entrepreneur, you see opportunities to grow. To do this, you need working capital. According to a publication through the Chamber of Commerce, 50% of entrepreneurs have a problem finding (sufficient) financing. Every year about 25% of entrepreneurs actively seek financing. Traditional banks, crowdfunding platforms and large investors reject the entrepreneur. Nowadays even up to 98% of funding requests. New alternative financiers reject up to 95% of entrepreneurs’ financing requests while providing limited financing at relatively high and often hidden costs. AFM advises not to do business with them. Banks have been financing fewer and fewer entrepreneurs since 2008. A negative trend that continues. Still, as an entrepreneur you have to move on so you keep looking for a financing solution. Unfortunately, there are parties in the market that suggest they have a network of investors. For usually a hefty payment, they (supposedly) introduce the entrepreneur to this exclusive network. Almost always this ends in failure and disappointment. There is no investor network where you can get in touch with investors who are waiting for your idea. At least, we haven’t found it. We are in contact with thousands of entrepreneurs. We don’t know anyone who has found this network. Parties that claim to have such an investor network are parties that abuse the trust of the entrepreneur. Fundingteam’s initiators are also entrepreneurs and have also run into this stone several times in their entrepreneurial lives. The light in the tunnel Having an excellent idea but insufficient working capital to really grow is, of course, frustrating. There needs to be a solution to that. Fundingteam was created to provide the entrepreneur with a solution to overcome the funding obstacle. This became possible because the initiators were informed of a relaxation of regulations and legislation by the European Parliament. This relaxation was also adopted into legislation in the Netherlands. Indeed, the relaxation of rules and legislation made it possible for the entrepreneur to approach the public or the market directly for financing. This was previously prohibited to the entrepreneur; it was even punishable as an economic crime. This is no longer the case. Fortunately, there is light in the tunnel. This relaxation has been made because it has also been noted in the European Parliament and the government in the Netherlands that the entrepreneur starting up or wanting to grow has basically nowhere to turn for financing. This obviously has negative consequences for innovation, the economy and society. The traditional banks, crowdfunding platforms, big investors or so-called consultants will not inform you about this easing, let alone help you with it. The vision However, the initiators of Fundingteam recognized that being able to address the public as an entrepreneur is only the beginning of the challenge. The relaxed regulations and legislation open up unprecedented opportunities for the entrepreneur but at the same time that is where the challenge begins. In order to successfully utilize this opportunity, the entrepreneur must form a “funding team” in which various disciplines and knowledge are represented, such as: legal knowledge regarding the loan agreements, legislative knowledge regarding the AFM, investor relations, design and marketing. AFM, investor relations, design and content, copywriting, finance, marketing sales, administration, tax, ICT IT. Entrepreneurs don’t have time for that and it costs too much. In this age of innovation, all this knowledge needs to come in one online platform. A platform that the entrepreneur can easily operate at a competitive rate. That is the challenge. To open this door for entrepreneurs, vision is needed. A funding platform that works In 2020, a few entrepreneurs, the initiators of Fundingteam, put their heads together. They care about entrepreneurship. They see the opportunities for entrepreneurs and it motivates them to take up the challenge. They outline an online all-in-one solution in 2020. In 2021, the first user-friendly online software for the platform will be tested. The first users issue loans and are successfully funded. The experiences contribute to further development of the platform in 2022. The group of entrepreneurs who finance themselves in this way grows. In 2023, the focus is on the scalability of the platform so that as many entrepreneurs as possible can benefit from it. This ensures a competitive low rate. Along the way, great people are joining who also care about the mission. They reinforce the added value. And now there is Fundingteam, the platform for every entrepreneur that works. Fundingteam, a movement of entrepreneurs Borrowing directly online from multiple investors is what we now call the Fundingteam methodology. Thousands of entrepreneurs successfully preceded you in this methodology. Financings of €25,000 to more than €1 million are realized with it. On our website you will find a number of videos of some of them. Fundingteam informs many thousands of entrepreneurs about the Fundingteam methodology. We do this without any obligation. If you want further help there is the Fundingteam platform. The Fundingteam platform is growing to a thousand users. More and more entrepreneurs are joining. Thus a community of Fundingteam entrepreneurs is created. A movement of entrepreneurs who see that they no longer depend on the approval of banks, expensive lenders or crowdfunding platforms.

A movement of entrepreneurs helping and supporting each other.

You use the experience of other Fundingteam entrepreneurs and in the future other Fundingteam entrepreneurs can learn from you again.

The Fundingteam platform facilitates this community. What to do. We find that many entrepreneurs, after discovering Fundingteam, wonder how to build their own network of investors. Isn’t that difficult? Can I do it? Do I have the time? Where should I start? I don’t know any investors. These are all understandable questions. You’re not the first and certainly not the only one with these concerns. This is how it begins for every Fundingteam entrepreneur. For many, this method of financing is new. And new can sometimes feel intimidating.

Fundingteam has answers to all your questions, guiding you and providing the tools you need. Entrepreneurs often feel like they have to step out of their comfort zone. Just beyond the comfort zone lies what many people call the “fear zone.” It’s a subconscious fear of the unknown, of adventure, and of change. But the reality is different—right outside the comfort zone lies the “opportunity zone.”

If you want to change your current financing situation, you’ll need to change your approach. With Fundingteam, taking a big step towards transforming your financial situation is, in reality, a small one. Many of our entrepreneurs tell us that deciding to simply start with Fundingteam was the best step they ever took. So, when you ask, “What should I do?” the answer is: “Take the first step.” Start with Fundingteam, and the next steps will naturally follow. How does it work? We hear you ask, “What exactly is Fundingteam? How does Fundingteam solve my challenge? How does it work? What do I need to do? What makes Fundingteam unique?”

Fundingteam is an online platform built specifically for entrepreneurs who are open to funding from multiple investors.

You no longer need a bank, crowdfunding platform or big investor who reject your funding request.

You can now do it yourself.

What makes Fundingteam unique and successful is its proven online funding strategy that leads multiple potential investors in the marketplace directly to invest in your business.

How it works. The loan With Fundingteam, you put together your own bond loan.

A bond loan is a regular loan but divided into units or bonds with the same conditions such as the interest rate and your repayment schedule.

Thanks to this bond loan there is clarity and multiple investors can participate at different entry dates. The funding funnel What makes Fundingteam unique is that with Fundingteam you have at your disposal proven Fundingteam funnels, a marketing and sales strategy to successfully promote and sell your bonds to multiple investors.

A funnel is the entire journey the investor takes from the moment they are unfamiliar with your company and your plan, to investing.

The funnel can mean the use of media, social media, PR, brochures, landing pages, mail, video, Fundingteam website, personal outreach and more.

With Fundingteam, you arrange the entire funnel.

You do this from behind your screen, online, at your convenience. Funding You receive every investment directly from the investor into your own bank account.

Any amount received is immediately available to you.

You build a network and maintain online contact with each investor with Fundingteam.

As soon as you want to place a follow-up loan you can also contact this group directly again.

At each step you will be supported on the Fundingteam platform.

This allows you to grow successfully and enjoy doing business.

The Fundingteam method is for the entrepreneur the best way to short- and long-term financing. Why do people invest in my business? There are a number of factors that go into getting funded quickly and successfully by multiple investors.

1. Good preparation is half the battle.

With Fundingteam, you have everything ready, from loan terms and payment options to online confirmations.

2. A great offer.

You offer a nice interest rate that’s higher than at the bank.

3. An experience.

You offer your story, your mission and purpose.

This creates affinity, connection and experience.

There are 8 million households with an average of €60,000 in their bank account.

(Source: DNB).

Some have more than others, of course.

But there is very much capital among the public.

A number of investors who invest a small portion of their liquid balance in you provide funding for your plans and growth.

You can quickly reach thousands or tens of thousands of people online.

All it takes is a relatively small number of them investing a limited amount and you are funded. Validate your revenue model The investors become your fans and ambassadors.

They don’t demand collateral.

As long as you are transparent, they are behind you.

However, investors must first gain confidence in you.

What is most convincing is being transparent with your earnings model.

It is your “proof of concept.

By this we don’t mean a comprehensive financial statement with high sales and high profits.

If you can show that every Euro you invest for your business yields significantly more, the investor understands what you are doing it for and the investor has confidence in paying the interest and repayment they receive.

So make sure you have a working revenue model.

Even if this is realized on a small scale.

You can then calculate if you increase this scale.

Do you have questions about this?

Fundingteam’s support team can help you with this.

Can’t you demonstrate that your investment is generating a good return for you.

Then it is wiser to wait with a campaign until you can demonstrate this.

This in the interest of yourself, your investors and stake holders. The enormous power of a built-up investment circle and audience Building your audience and investor circle does not happen automatically but it is definitely a fun and interesting task.

In building your investor circle you invest time and also money.

In that respect, building an investor circle is similar to building your customer base.

Your investor base is well worth the investment.

Not only does it provide funding for your plans and the financial benefits this brings in the short term, but you have also laid a solid foundation for your future and growth.

Experience shows that funding during your first campaign, will also quickly become available again during your next campaign from the same investment circle. One investor may choose not to invest more or only a limited amount, while another may invest the same or significantly more than their initial investment. This happens when you fulfill your obligations and maintain ongoing communication with your investors online. Additionally, you can continue expanding your circle of investors. Your investment network grows as existing investors reinvest and increase their contributions. The average investment amount increases. Through recommendations, the number of investors also grows. Moreover, the number of new investors increases if you allow your campaign to run steadily. Besides many small investments, we often see larger investment amounts come into play after wealthier investors have had time to assess the situation. The difference between traditional investors and financiers The biggest difference between the Fundingteam method and traditional financiers is that with the Fundingteam method, any entrepreneur can get started immediately and secure funding, while traditional parties tend to reject, set high demands, and often pose a threat when things don’t go well. It’s much easier to be financed by 40 investors each contributing an average of €2,500 than by one who provides €100,000. The Fundingteam method also avoids the hassle with figures, meaning no expensive accounting fees. There are no mandatory personal guarantees or collateral requirements, and no “special management” oversight. You can get started right away. There are no minimum, target, or maximum amounts you need to meet, and you have all the time you need, unlike the 30-day limit of a crowdfunding platform. Why are your own campaigns more effective than you expect? Self-promoting your bond loan directly online with Fundingteam is more effective than most entrepreneurs expect.

Yet the explanation is simple.

We sometimes compare this to the image of a busy shopping street with lots of people passing by.

Suppose you are present in the shopping street but you have no door, no hanging sign and no shop window.

Then, of course, passersby don’t know you exist, what you do or what you offer.

No one shows interest.

Now the situation that you do have a wide front door and open it, a clear window display and prominent hanging sign.

Many passersby look for a moment but still walk on, some look in your window for a moment, a few come in and some of them buy from you.

Later people come back, who didn’t have time at first.

Some of them also buy from you.

Occasionally there is even a visitor who buys from you very much.

You wouldn’t have all this business if you didn’t show that you were offering something for sale.

It’s exactly the same with selling bonds.

If you don’t offer bonds or let people know they are for sale, there is no interest.

By offering them through a clever online marketing and sales strategy, you will sell.

There is demand for your bonds.

The issue is how many people are you reaching?

There are more than you think, and that makes your own campaigns more effective than you think. Our question: How businesslike are you?

What will be your story? You’ve now discovered Fundingteam’s story.

You also know that Fundingteam is all about your interest.

What will be your story?

Are you looking for funding for your plans and growth?

Do you also recognize the great challenge that up to 98% of entrepreneurs face?

If so, the same obstacles also stand in the way of your potential and opportunities.

You are faced with a choice.

– Do nothing.

Continue to tread water financially for years without real progress.

Meanwhile, you miss your opportunities.

With all the associated risks.

– Or accept the challenge and seize your opportunities in time.

Overcome the threshold and yourself.

Choose the shortest path to growth, success and entrepreneurship.

Choose the challenge and stop missing your opportunities.

Then the Fundingteam story will also become your story.

Fundingteam’s success becomes your success. Funding, what does it get you? Many businesses and entrepreneurs, when they spend something, don’t just look at “what will it cost me?” but they look primarily at “what will it get me? Sometimes it results in you being able to run your primary business better. Sometimes it leads to value development of your business. Sometimes financing allows you to break through your glass ceiling and you are no longer trapped and limited. Sometimes it makes something possible that would otherwise be impossible. Sometimes borrowing is a good investment with a good return of sometimes tens or hundreds of percent on working capital. This is how you calculate it! Welk rendement haal jij op jouw investering in je campagne? Stel, je investeert €1.000 per maand aan marketing om je obligaties te verkopen. De obligaties lopen 5 jaar tegen 6% rente. Dit kan betekenen dat je al snel maandelijks €12.000 aan obligaties verkoopt. Na een jaar is dit €144.000 aan obligaties die op je bankrekening is binnen gekomen. In totaal heeft dit €12.000 aan marketing gekost. In 5 jaar tijd behaal je door de omloopsnelheid van je werkkapitaal circa €100.000 rendement. Je trekt hier de betaalde rente en je marketingkosten van af. Dan kun je een marge overhouden van 50% van het bruto rendement c.q. €50.000. Let wel, dit is geen rendement van 50% maar ten opzichte van je marketing-investering van €12.000 ruim 400% marge. Ga je een stap verder en financier jij je campagne via de campagne dan is je basis investering in de marketing feitelijk enkel de €1.000 van de eerste maand geweest. Het rendement op je investering is dan 5.000%. We laten hier nog buiten beschouwing dat veel van je obligatiehouders, met de Fundingteam methode, bij een volgende lening weer graag voor hetzelfde bedrag of meer mee willen doen. In feite verdubbel jij je rendement. What does a Fundingteam Flex subscription cost? A Flex subscription from Fundingteam is designed to grow with your business and funding needs inexpensively and affordably.

You can grow your Flex subscription flexibly with funding bundles.

A funding-bundle gives you access to a capacity of €50.000 of collectable capital.

These funding bundles can be flexibly stacked.

So if your €50,000 funding bundle is full (and you have €50,000 in your bank account), you can add another funding bundle.

That way you can get any amount you want.

You can purchase up to 100 funding bundles, so you can fund up to €5 million in total using Fundingteam.

With a Flex subscription you invest in your first funding bundle a one-time set-up fee of €995 excluding VAT.

Per subsequent funding bundle you pay 1% of the funding bundle as a one-time set-up fee so €500.

Suppose your funding runs over 5 years, this comes to only €100 per year.

This is 0.2% per year of €50,000.

For the subscription you pay for each funding bundle you use 0.1% per month in advance, so €50.

If you pay the monthly subscription per funding bundle per year in advance, you will receive a discount of 40%.

This means only €30 per month.

For the cost of your Fundingteam Flex subscription you don’t have to miss out.

On your account you can indicate a stop when the funding-bundle is full (temporarily or not) or you can automatically extend the ceiling of the funding-bundle with a subsequent funding-bundle.

On your account, you can put the subscription fee for the following month on pause.

The direct debit will stop and certain features will no longer be accessible.

If you pay per year in advance, this pause also applies and you keep the remaining months.

These will move up.

You can resume your subscription with one click. The Start subscription There is also a Start subscription.

The set-up costs are €495 excluding VAT and the monthly subscription is then €25 excluding VAT per month.

With the Start subscription you can collect up to €25,000 in working capital.

Do you want to sell more bonds after this?

Then you can upgrade to a Flex subscription by only paying the difference. Not satisfied? Money Back When you enter into a subscription, there is a 14-day satisfaction guarantee. If Fundingteam isn’t what you’re looking for, you get your set-up fee back. About 10% of business owners take advantage of this. That’s fine. Fundingteam is here to help entrepreneurs. If you believe in yourself, we believe in you Can any entrepreneur use Fundingteam? Yes. Chamber of Commerce registration is required but otherwise everyone is welcome. What does it take to be successful? Believe in yourself. If you believe in yourself and your plan, we believe in you. You also need a validated business model and the drive to grow this business model and make it profitable. Finally, you need your “story,” but we’ll help you with that on the Fundingteam platform. Our support team is ready for you Fundingteam has a support team of passionate people. The team is daily ready to inform and support every entrepreneur. So every entrepreneur quickly becomes familiar with the unprecedented possibilities of the Fundingteam method and the Fundingteam platform. Building success together. Have questions? We’d love to hear from you. Call us, email us, chat with us, visit us. You can also schedule a free consultation so you can ask anything and we can explain everything. We’ll try to help you as quickly as possible because Fundingteam is here for you! A user tells …Take the bike One user compares Fundingteam to a bicycle. “Many entrepreneurs are walking financially. No matter how fast you walk, others pass you by. One accepts the maximum walking pace. The other really wants to move faster anyway. Now it is possible for every entrepreneur to take the bike. You catch up with others and your lead grows. In the same time and with the same energy, every pedal gets you much further. I see Fundingteam as a tool, as that bicycle. The Fundingteam methodology has ensured that I have adequate working capital. Even as I grow, the working capital grows with me. This would not have been possible otherwise. It gives me more satisfaction and pleasure every day.” We can agree with this user’s bicycle comparison. With Fundingteam, not everything suddenly happens by itself. You still have to do something for it but in the same time and with the same energy you will get further with Fundingteam than without, much further. So do you really want to move forward? Take the bike … uuhh Fundingteam. What if you started Fundingteam? With your subscription, you can get started right away. Your Funding Team has quite a few options. For example, your funding is customized. Issuing your customized bond is easy thanks to its ease of use and simplicity. Plus, you’re supported every step of the way on the Fundingteam platform. We explain how Fundingteam works.  There are three important topics to consider when issuing and selling your bonds. We cover these briefly here and come back to them in a little more detail in various sections.

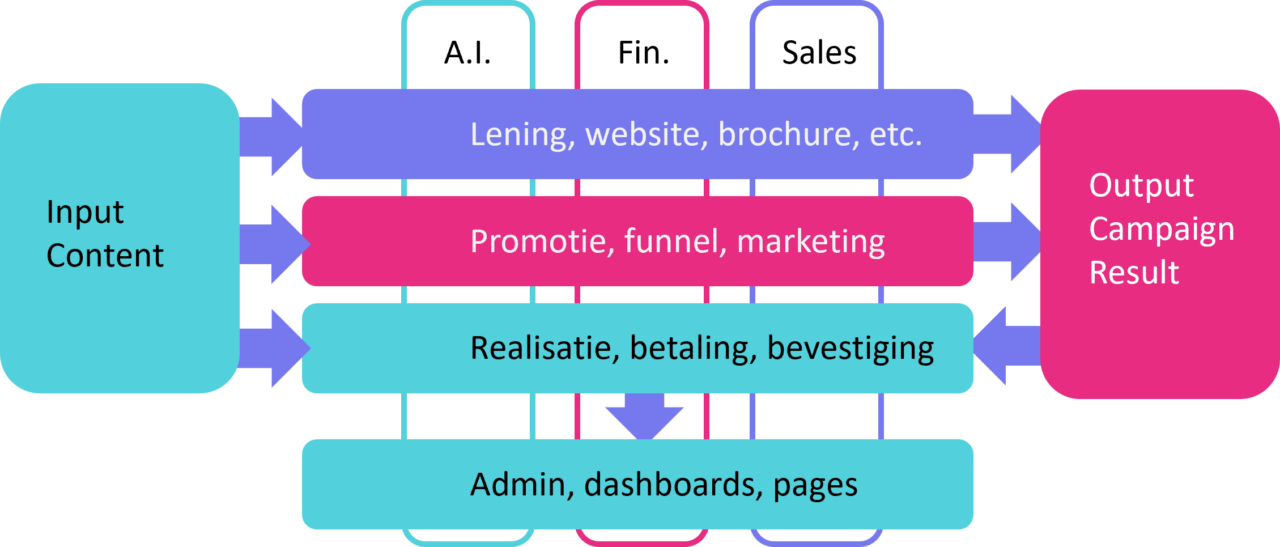

There are three important topics to consider when issuing and selling your bonds. We cover these briefly here and come back to them in a little more detail in various sections.

- The loan: With Fundingteam you create your own bond loan. A bond loan is a regular loan but divided into units or bonds, with the same conditions such as the interest rate and your repayment schedule. Thanks to this bond loan there is clarity and multiple investors can participate on different entry dates.

- The funding funnel: What makes Fundingteam unique is that with Fundingteam you have proven Fundingteam funnels, a marketing and sales strategy to successfully promote and sell your bonds to multiple investors. A funnel is the entire journey from the moment the investor is unfamiliar with your company and your plan, to investing. The funnel can mean the use of media, social media, PR, brochures, landing pages, mail, video, Fundingteam website, personal outreach and more. With Fundingteam, you arrange the entire funnel. You do this behind your screen, online, at your convenience.

- Funding: You receive each investment directly from the investor into your own bank account. Any amount received is immediately available to you. You build a network and maintain online contact with each investor with Fundingteam. As soon as you want to place a follow-up loan you can also contact this group directly again.

The entire process of issuing and selling your bonds is streamlined and clear with Fundingteam. This allows you to grow successfully and enjoy doing business. The loan: interest tunnel When you issue a bond, you decide how much interest you pay your investors. What should you take into account? First, it is important to know what you want to finance. Next, you need to calculate what the financing will get you. Your calculation should be based on a validated business model. You don’t want to speculate with other people’s money because that will get your investors and ultimately you into trouble. If you know what the financing brings you, you also know how much interest you can responsibly give. The interest you can give is not always the interest you give. We regularly hear business owners who are willing to pay 12% or 15% interest. We also hear that people are not willing to pay more than 3% interest. Our advice is to keep your interest rate within the “interest rate tunnel. The interest rate tunnel moves between 4% to 5% at the bottom and 8% at the top. An interest rate below 4% is not always worthwhile for the investor to invest an amount. In a period of bank interest rates that can be around 3%, 1% or 2% more is often insufficiently motivating. If you cannot pay 4% or more interest it is also questionable whether it is not too early to issue a bond. Your margin on your financing is then also apparently low. Of course, the amount of your interest rate will determine how quickly you realize your desired financing. Perhaps an individual investor will be satisfied with say 3% to 4% but with the Fundingteam method it’s all about the group of potential investors. When will they take the step? We immediately add that the interest rate is not the only motivation for potential investors. It is also about affinity with your ‘story’, product, region, your person, industry/sector, and/or your mission and drive. An interest rate above 8% is also not recommended. Again, an individual investor may find an interest rate higher than 8% interesting but the Fundingteam method is mainly about how the public or the large group of potential investors looks at your interest rate. Too high an interest rate arouses suspicion or questions of feasibility. Even if you yourself are convinced that you can easily bear a high interest rate. At the same time, we must warn the entrepreneur against too much optimism regarding the feasibility of a high interest rate. Always allow for unexpected setbacks and margin to absorb it. The loan: How much do you repay and when? One of your terms that you determine when putting together your bond terms is your repayment schedule. For many entrepreneurs who start issuing a bond, it seems ideal to repay the loan in full at once after, say, 5 years. One is then not stuck with interim repayments and that saves on cash flow. Experience shows that this approach does not give the best results with regard to the success of selling the bonds. There are a number of reasons why it is wiser to repay your bond loan in installments. Repaying your loan only after 5 years means the investor has to wait 5 years to see if you will actually repay. This makes it more difficult to sell your bonds to investors. Again, an individual investor may not object to a late redemption. What matters when selling your bonds is how they are received by your potential investors. Regular redemption is better. Redemption can be monthly or quarterly. The risk for investors is then a lot lower. After all, after a few years they have already returned a significant portion of the bond. The risk becomes less and less. After 5 years, only the last installment remains. This makes it more attractive for investors. There is another reason why regular redemption gives the best results. Each payment of principal and interest is a moment of contact between you and the investor. It is a moment through which you highlight your company and you can further inform your investors because investors like to be involved. Your online communication is very important. In addition, each payment of principal and interest is a confirmation that you are keeping to agreements. This is how you build trust. The prompt payment of principal and interest, together with the communication, ensures that if you issue a follow-up loan, it will sell out quickly. Precisely because investors have often invested a relatively small amount, on average the investment is easily extended. So you can get your growth better financed because on average you can sell more new bonds in a period of time than you can redeem on your current bonds. Suppose an investor invests €2,400 and you redeem it in 60 months, which is €40 per month. The investor can decide to invest €2,400 again in your bonds after three months (i.e. repayment of €120). Especially with an average of 20, 40 or 100 investors, this is a huge source of funding that helps you grow. You can also decide to sell only as many bonds as you repay to the existing bonds. In this way, you create a revolving business loan. Besides these, there are many other variations possible. Your Funding expert can advise you on this. Finally, we point out the possibility through Fundingteam to include a grace period in your bond conditions. So you can choose not to repay for the first three, six, nine or 12 months. The loan: Are you providing collateral? If you borrow money from a bank, crowdfunding platform or alternative lender, you can only do so if you provide them with ample collateral. Almost always, you will also be asked to stand as a private guarantor for the loan. These securities are not released until you have repaid everything, even if the securities are no longer proportional to the outstanding loan. This means that these securities are not released for new financing. If things go wrong in the interim, you go to Special Management and the loan can become payable immediately. If you do not succeed in repaying the loan immediately, “Bijzonder Beheer” starts to extract all cash flow and securities. It is the beginning of the end. If the cow does not give enough milk then the cow is slaughtered. These professional institutions are not on the side of the entrepreneur but on the side of their investors. Their investors or shareholders are their customers. The entrepreneur remains the cash cow for them. Fundingteam thinks from the entrepreneur’s point of view. The Fundingteam method targets multiple investors who don’t know you yet but with whom you will build an (investor) relationship. These investors are not “professional investors. They have a different profession or are retired, for example. They are often entrepreneurs or people who have an affinity for entrepreneurship. They are interested in a nice interest rate but in terms of investing, they are individuals. They invest a relatively small amount of their liquidity and assets. Therefore, they can decide quickly and without hassle. We see that investors at Fundingteam entrepreneurs are not interested in securities, they are more interested in you and your business. Does this mean that Fundingteam does not consider the investors’ interests important? No, Fundingteam considers the interest of the investor at least as important as the interest of the Fundingteam entrepreneur. That’s why we think it’s important that the entrepreneur makes bond commitments that the entrepreneur can meet. That’s what Fundingteam thinks about. Why. Having a circle of investors is one of the most important strengths of a company. Especially when times are tough, a good relationship with your circle of investors can make all the difference. We see the Fundingteam entrepreneur and his circle of investors as “partners in business” and not as each other’s opponent. This is reflected in the bond conditions and the operation of the Fundingteam platform. Suppose things are unforeseen. An entrepreneur simply sticks his neck out. Or as an entrepreneur you grow faster than expected. Then it can be in everyone’s interest to be able to skip one or more repayments. This gives the entrepreneur room to intervene and recover. As a Fundingteam entrepreneur you can inform investors about this and the missed repayment can be spread over the remaining repayment periods. This optimizes the desired outcome for everyone. The funding funnel: To invest or not to invest in your funding campaign? There may be several reasons why you are unsure about whether or not to invest in marketing sales of your bonds. It’s a good idea to go through the following checklist with us to see what applies to you:

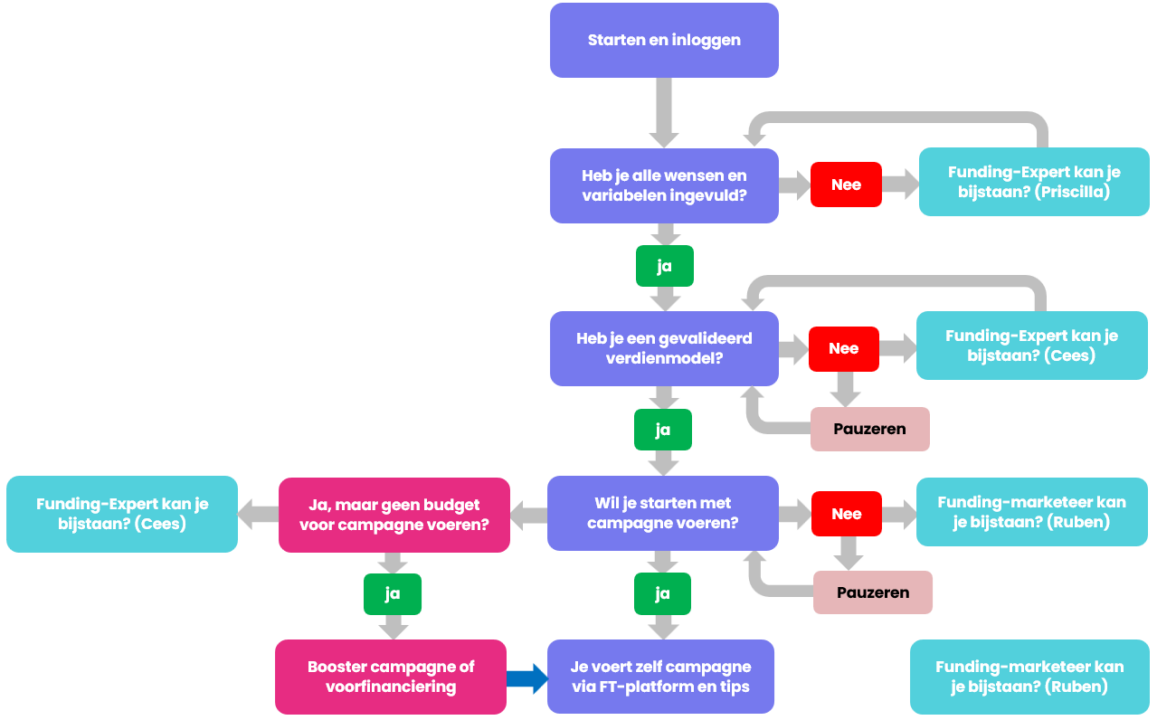

The entire process of issuing and selling your bonds is streamlined and clear with Fundingteam. This allows you to grow successfully and enjoy doing business. The loan: interest tunnel When you issue a bond, you decide how much interest you pay your investors. What should you take into account? First, it is important to know what you want to finance. Next, you need to calculate what the financing will get you. Your calculation should be based on a validated business model. You don’t want to speculate with other people’s money because that will get your investors and ultimately you into trouble. If you know what the financing brings you, you also know how much interest you can responsibly give. The interest you can give is not always the interest you give. We regularly hear business owners who are willing to pay 12% or 15% interest. We also hear that people are not willing to pay more than 3% interest. Our advice is to keep your interest rate within the “interest rate tunnel. The interest rate tunnel moves between 4% to 5% at the bottom and 8% at the top. An interest rate below 4% is not always worthwhile for the investor to invest an amount. In a period of bank interest rates that can be around 3%, 1% or 2% more is often insufficiently motivating. If you cannot pay 4% or more interest it is also questionable whether it is not too early to issue a bond. Your margin on your financing is then also apparently low. Of course, the amount of your interest rate will determine how quickly you realize your desired financing. Perhaps an individual investor will be satisfied with say 3% to 4% but with the Fundingteam method it’s all about the group of potential investors. When will they take the step? We immediately add that the interest rate is not the only motivation for potential investors. It is also about affinity with your ‘story’, product, region, your person, industry/sector, and/or your mission and drive. An interest rate above 8% is also not recommended. Again, an individual investor may find an interest rate higher than 8% interesting but the Fundingteam method is mainly about how the public or the large group of potential investors looks at your interest rate. Too high an interest rate arouses suspicion or questions of feasibility. Even if you yourself are convinced that you can easily bear a high interest rate. At the same time, we must warn the entrepreneur against too much optimism regarding the feasibility of a high interest rate. Always allow for unexpected setbacks and margin to absorb it. The loan: How much do you repay and when? One of your terms that you determine when putting together your bond terms is your repayment schedule. For many entrepreneurs who start issuing a bond, it seems ideal to repay the loan in full at once after, say, 5 years. One is then not stuck with interim repayments and that saves on cash flow. Experience shows that this approach does not give the best results with regard to the success of selling the bonds. There are a number of reasons why it is wiser to repay your bond loan in installments. Repaying your loan only after 5 years means the investor has to wait 5 years to see if you will actually repay. This makes it more difficult to sell your bonds to investors. Again, an individual investor may not object to a late redemption. What matters when selling your bonds is how they are received by your potential investors. Regular redemption is better. Redemption can be monthly or quarterly. The risk for investors is then a lot lower. After all, after a few years they have already returned a significant portion of the bond. The risk becomes less and less. After 5 years, only the last installment remains. This makes it more attractive for investors. There is another reason why regular redemption gives the best results. Each payment of principal and interest is a moment of contact between you and the investor. It is a moment through which you highlight your company and you can further inform your investors because investors like to be involved. Your online communication is very important. In addition, each payment of principal and interest is a confirmation that you are keeping to agreements. This is how you build trust. The prompt payment of principal and interest, together with the communication, ensures that if you issue a follow-up loan, it will sell out quickly. Precisely because investors have often invested a relatively small amount, on average the investment is easily extended. So you can get your growth better financed because on average you can sell more new bonds in a period of time than you can redeem on your current bonds. Suppose an investor invests €2,400 and you redeem it in 60 months, which is €40 per month. The investor can decide to invest €2,400 again in your bonds after three months (i.e. repayment of €120). Especially with an average of 20, 40 or 100 investors, this is a huge source of funding that helps you grow. You can also decide to sell only as many bonds as you repay to the existing bonds. In this way, you create a revolving business loan. Besides these, there are many other variations possible. Your Funding expert can advise you on this. Finally, we point out the possibility through Fundingteam to include a grace period in your bond conditions. So you can choose not to repay for the first three, six, nine or 12 months. The loan: Are you providing collateral? If you borrow money from a bank, crowdfunding platform or alternative lender, you can only do so if you provide them with ample collateral. Almost always, you will also be asked to stand as a private guarantor for the loan. These securities are not released until you have repaid everything, even if the securities are no longer proportional to the outstanding loan. This means that these securities are not released for new financing. If things go wrong in the interim, you go to Special Management and the loan can become payable immediately. If you do not succeed in repaying the loan immediately, “Bijzonder Beheer” starts to extract all cash flow and securities. It is the beginning of the end. If the cow does not give enough milk then the cow is slaughtered. These professional institutions are not on the side of the entrepreneur but on the side of their investors. Their investors or shareholders are their customers. The entrepreneur remains the cash cow for them. Fundingteam thinks from the entrepreneur’s point of view. The Fundingteam method targets multiple investors who don’t know you yet but with whom you will build an (investor) relationship. These investors are not “professional investors. They have a different profession or are retired, for example. They are often entrepreneurs or people who have an affinity for entrepreneurship. They are interested in a nice interest rate but in terms of investing, they are individuals. They invest a relatively small amount of their liquidity and assets. Therefore, they can decide quickly and without hassle. We see that investors at Fundingteam entrepreneurs are not interested in securities, they are more interested in you and your business. Does this mean that Fundingteam does not consider the investors’ interests important? No, Fundingteam considers the interest of the investor at least as important as the interest of the Fundingteam entrepreneur. That’s why we think it’s important that the entrepreneur makes bond commitments that the entrepreneur can meet. That’s what Fundingteam thinks about. Why. Having a circle of investors is one of the most important strengths of a company. Especially when times are tough, a good relationship with your circle of investors can make all the difference. We see the Fundingteam entrepreneur and his circle of investors as “partners in business” and not as each other’s opponent. This is reflected in the bond conditions and the operation of the Fundingteam platform. Suppose things are unforeseen. An entrepreneur simply sticks his neck out. Or as an entrepreneur you grow faster than expected. Then it can be in everyone’s interest to be able to skip one or more repayments. This gives the entrepreneur room to intervene and recover. As a Fundingteam entrepreneur you can inform investors about this and the missed repayment can be spread over the remaining repayment periods. This optimizes the desired outcome for everyone. The funding funnel: To invest or not to invest in your funding campaign? There may be several reasons why you are unsure about whether or not to invest in marketing sales of your bonds. It’s a good idea to go through the following checklist with us to see what applies to you:  1. You are reluctant to fill in the requirements and data on the Fundingteam platform. You think it’s a lot of hassle and complicated. We can understand that. Not everyone is familiar with working online or they are far too busy. Again, help can be provided by a Fundingteam expert such as Cees or Priscilla. They can guide you through the process of filling it out. 2. You do not (yet) have a well-validated earnings model. If you are not convinced that funding can offer substantial financial benefits, it is wise not to invest in a campaign yet. You would be putting yourself and investors in unnecessary trouble. A Fundingteam expert or the Fundingteam Academy can help you with what a validated revenue model should meet. 3. You do have a validated and good earnings model If there is a good earnings model and, according to you, financing provides a good return for your company after interest and repayment, then there need not be any doubt or discussion regarding the usefulness of investing in a campaign. A Fundingteam expert or the Fundingteam Academy can help you spread the word about your validated revenue model. 4. You have a well-validated revenue model but you don’t know how investing in a campaign works. Through a Fundingteam expert or the Fundingteam Academy, we would be happy to explain to you how the Fundingteam funnel strategy works and what commitment you can make in terms of funding. Suppose, an outcome could be that €100 investment in the campaign yields approximately €1,100 of collected capital. Would you invest this €1,100 this could yield €11,100. For example, the €11,100 yields €111,000. In this example, starting with €100 results in funding of €111,000. This has cost approximately €11,100. Suppose, with your validated revenue model, you achieve 100% return on the €100,000 funding in 5 years. After campaign costs and interest, you are left with a good return. This is your so-called funding profit. Do you have less time or do you want to outsource certain tasks? Then you can let one of our Funding-marketeers assist you. (Ruben can contact you). 5. You have a well-validated revenue model and also see the usefulness and return of a campaign but you simply do not have the budget to start a campaign. What many entrepreneurs do in such a situation is to borrow a limited amount of money within the relationship circle. This can be done using the Fundingteam platform by creating a small loan but you can also do this informally outside of Fundingteam platform. We call this a so-called booster loan. (Like from the booster rockets). Suppose you borrow €500 from 5 people then you have €2,500 marketing budget to run your campaign. We often see entrepreneurs raising €25,000 or more by then. If you want, you can pay back the ‘booster loan’ to your relations with a nice interest or bonus from the collected capital of the campaign. (The booster rockets then neatly return and land). However, we see that often these relations find it fine to (continue to) participate in the campaign. If you want to know how this can work, please contact our Funding Team Expert Cees who can guide you through a booster campaign. We can help you with the proven Fundingteam methodology. The Fundingteam methodology works for any entrepreneur. The platform, the methodology and the market is there. You, as an active entrepreneur, are the determining factor.

1. You are reluctant to fill in the requirements and data on the Fundingteam platform. You think it’s a lot of hassle and complicated. We can understand that. Not everyone is familiar with working online or they are far too busy. Again, help can be provided by a Fundingteam expert such as Cees or Priscilla. They can guide you through the process of filling it out. 2. You do not (yet) have a well-validated earnings model. If you are not convinced that funding can offer substantial financial benefits, it is wise not to invest in a campaign yet. You would be putting yourself and investors in unnecessary trouble. A Fundingteam expert or the Fundingteam Academy can help you with what a validated revenue model should meet. 3. You do have a validated and good earnings model If there is a good earnings model and, according to you, financing provides a good return for your company after interest and repayment, then there need not be any doubt or discussion regarding the usefulness of investing in a campaign. A Fundingteam expert or the Fundingteam Academy can help you spread the word about your validated revenue model. 4. You have a well-validated revenue model but you don’t know how investing in a campaign works. Through a Fundingteam expert or the Fundingteam Academy, we would be happy to explain to you how the Fundingteam funnel strategy works and what commitment you can make in terms of funding. Suppose, an outcome could be that €100 investment in the campaign yields approximately €1,100 of collected capital. Would you invest this €1,100 this could yield €11,100. For example, the €11,100 yields €111,000. In this example, starting with €100 results in funding of €111,000. This has cost approximately €11,100. Suppose, with your validated revenue model, you achieve 100% return on the €100,000 funding in 5 years. After campaign costs and interest, you are left with a good return. This is your so-called funding profit. Do you have less time or do you want to outsource certain tasks? Then you can let one of our Funding-marketeers assist you. (Ruben can contact you). 5. You have a well-validated revenue model and also see the usefulness and return of a campaign but you simply do not have the budget to start a campaign. What many entrepreneurs do in such a situation is to borrow a limited amount of money within the relationship circle. This can be done using the Fundingteam platform by creating a small loan but you can also do this informally outside of Fundingteam platform. We call this a so-called booster loan. (Like from the booster rockets). Suppose you borrow €500 from 5 people then you have €2,500 marketing budget to run your campaign. We often see entrepreneurs raising €25,000 or more by then. If you want, you can pay back the ‘booster loan’ to your relations with a nice interest or bonus from the collected capital of the campaign. (The booster rockets then neatly return and land). However, we see that often these relations find it fine to (continue to) participate in the campaign. If you want to know how this can work, please contact our Funding Team Expert Cees who can guide you through a booster campaign. We can help you with the proven Fundingteam methodology. The Fundingteam methodology works for any entrepreneur. The platform, the methodology and the market is there. You, as an active entrepreneur, are the determining factor.